What Does Insurance Agency In Dallas Tx Mean?

Wiki Article

The Definitive Guide for Insurance Agency In Dallas Tx

Table of ContentsThe smart Trick of Commercial Insurance In Dallas Tx That Nobody is Discussing3 Simple Techniques For Truck Insurance In Dallas TxHow Insurance Agency In Dallas Tx can Save You Time, Stress, and Money.Getting The Commercial Insurance In Dallas Tx To WorkSome Known Details About Home Insurance In Dallas Tx Home Insurance In Dallas Tx for Beginners

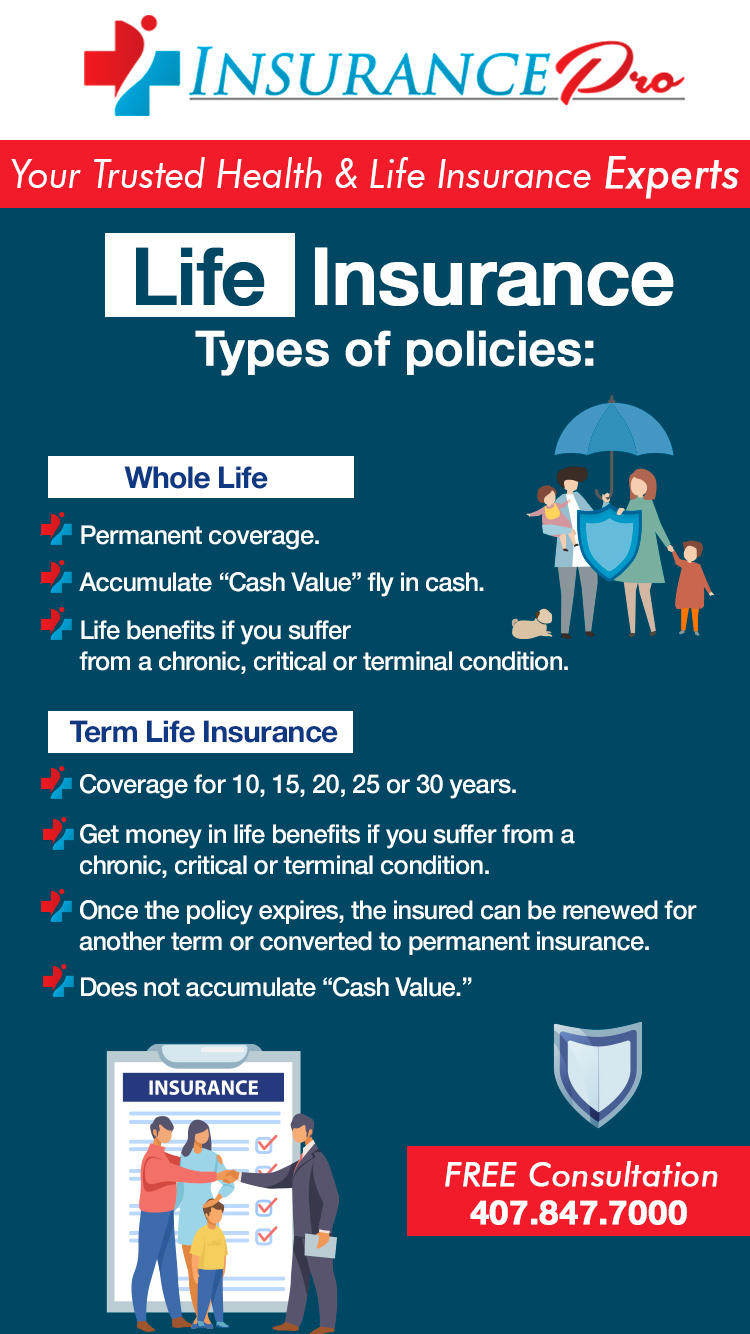

And because this coverage lasts for your whole life, it can assist support long-term dependents such as children with disabilities. Disadvantage: Expense & complexity an entire life insurance plan can be dramatically extra costly than a term life policy for the same death advantage quantity. The cash worth element makes entire life a lot more complex than term life due to costs, taxes, interest, and various other stipulations.

Riders: They're optional attachments you can utilize to personalize your policy. Term life insurance coverage policies are normally the finest solution for people that need budget-friendly life insurance for a specific period in their life.

Life Insurance In Dallas Tx Can Be Fun For Everyone

" It's constantly suggested you talk with a certified representative to establish the very best service for you." Collapse table Currently that you're acquainted with the basics, below are extra life insurance coverage policy kinds. Much of these life insurance policy options are subtypes of those included over, indicated to serve a specific purpose.Pro: Time-saving no-medical-exam life insurance coverage provides quicker accessibility to life insurance coverage without having to take the medical test (Home insurance in Dallas TX). Disadvantage: Individuals that are of old age or have several health problems might not be eligible. Best for: Anybody that has couple of wellness complications Supplemental life insurance, additionally called voluntary or voluntary extra life insurance policy, can be utilized to connect the protection void left by an employer-paid team plan.

Unlike various other plan kinds, MPI only pays the survivor benefit to your home mortgage loan provider, making it a a lot more restricted alternative than a traditional life insurance policy policy. With an MPI plan, the recipient is the home mortgage firm or lender, as opposed to your family, as well as the fatality advantage lowers gradually as you make home loan settlements, similar to a reducing term life insurance policy.

Health Insurance In Dallas Tx - Truths

Since AD&D only pays under specific scenarios, it's not a suitable alternative to life insurance. AD&D insurance only pays out if you're harmed or killed in a mishap, whereas life insurance pays out for most reasons of fatality. Due to this, AD&D isn't appropriate for everyone, but it might be valuable if you have a risky occupation.

The smart Trick of Truck Insurance In Dallas Tx That Nobody is Talking About

Best for: Pairs who do not get approved for 2 specific life insurance policy plans, There are 2 main sorts of joint life insurance policy plans: First-to-die: The policy pays after the first of the two partners dies. First-to-die is the most similar to an individual life insurance policy plan. It a fantastic read helps the making it through insurance holder cover expenditures after the loss of financial backing.They'll be able to help you contrast life insurance policy service providers promptly and conveniently, and also find the best life insurance coverage firm for your situations. What are both main types of life insurance? Term and also irreversible are both primary kinds of life insurance coverage. The main difference in between both is that term life insurance policy plans have an expiry date, providing insurance coverage between 10 as well as 40 years, as well as long-term policies never expire.

Both its period and also money worth make long-term life insurance coverage several times a lot more costly than term. Term life insurance is typically the most budget friendly and extensive kind of life insurance coverage because it's basic and supplies monetary protection during your income-earning years.

How Insurance Agency In Dallas Tx can Save You Time, Stress, and Money.

Whole, global, indexed universal, variable, as well as burial insurance policy are all sorts of irreversible life insurance policy. Irreversible life insurance policy usually features a cash value and has greater costs. What is the most typical kind of life insurance policy? Term life as well as entire life are the most preferred types of life insurance coverage.life insurance policy market in 2022, according to LIMRA, the life insurance policy study organization. On the other hand, term life premiums represented 19% of the market share in the same duration (bearing in mind that term life costs are much less costly than whole life costs).

There are four standard parts to an insurance coverage agreement: Affirmation Web page, Insuring Agreement, Exemptions, Problems, It is crucial to comprehend that multi-peril plans might have certain exclusions and problems for each sort of coverage, such as collision insurance coverage, medical settlement protection, responsibility coverage, and so forth. You will certainly need to ensure that you review the language for the certain coverage that uses to your loss.

The Basic Principles Of Commercial Insurance In Dallas Tx

g. $25,000, $50,000, and so on). This is a summary of the major guarantees of the insurance provider as well as specifies what is covered. In the Insuring Agreement, the insurer navigate to this site concurs to do particular things such as paying losses for covered risks, offering particular solutions, or consenting to protect the guaranteed in an obligation legal action.Instances of omitted residential property under a house owners plan are individual property such as an automobile, a pet, or a plane. Problems are provisions inserted in the policy that qualify or place restrictions on the insurer's debenture or perform. If the policy problems are not fulfilled, the insurance company can deny this hyperlink the case.

Report this wiki page